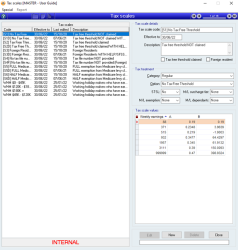

Tax scales

Tax scales form the basis of the calculations used to find the tax payable by an employee on their wages.

Every Employee must be assigned exactly one Tax scale. An employee’s tax scale is used to calculate the tax payable on the employee’s taxable income.

- No practical limit to the number of tax scales that can be created

- Internal tax scales have been included to allow for easy tax scale updates

- Up to 20 tax scale coefficients can be entered for each tax scale

Module: Payroll

Category: Tax scales

Activation: Main > Payroll > Setup > Tax scales

Form style: Multiple instance, SODA

Special actions available for users with Administrator permissions:

- Change the User ID of the Entered by field of memos.

- Edit memos entered by other users.

Database rules:

- A tax scale cannot be deleted if it is used by any Employee record

Reference: date, QuickList, mandatory

The date the tax scale is effective to. If the effective to date has passed you will receive a message when processing a pay run that one or more of your tax scales is out of date.

New tax scales will be emailed from support each year, if you have not received the email with the new tax scales please contact support.

Reference: memo, expandable

This is a description of the tax scale and the circumstances under which it should be used.

Reference: select from list

This classifies the tax scales as follows:

Regular (R)

Actors (A)

Horticulturists and shearers (C)

Seniors and pensioners (S)

Working holiday makers (H)

Seasonal workers program (W)

Foreign resident (F)

No TFN (N)

ATO defined (D)

Voluntary agreement (V)

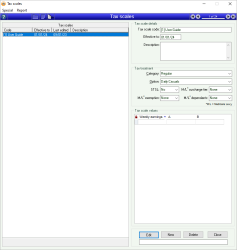

Reference: select from list

A list of options will be available based on the category chosen.

Reference: select from list

Study and training support loan - if available for the category and option you can choose yes or no. If not available for the category and option, it will default to no.

Reference: select from list

Medicare levy surcharge - if tiers are available for the category and option they will show in this box. If not available for the category and option, it will default to none.

Reference: select from list

Medicare levy exemption - if exemptions are available for the category and option they will show in this box. If not available for the category and option, it will default to none.

Reference: select from list

Medicare levy dependants - if dependants are available for the category and option they will show in this box. If not available for the category and option, it will default to none.

Reference: currency

The entries in this column represent the weekly earnings amounts for the tax scale. This amount is the amount less than which the employee must earn in a normal week to use the associated coefficients.

The weekly earnings (W), coefficient A and coefficient B are used to calculate tax in the following way:

- Tax = A x W – B.

Reference: quantity

The entries in this column represent the A coefficient for the tax calculation.

The weekly earnings (x), coefficient A and coefficient B are used to calculate tax in the following way:

- Tax = A x W – B

Reference: quantity

The entries in this column represent the B coefficient for the tax calculation.

The weekly earnings (x), coefficient A and coefficient B are used to calculate tax in the following way:

- Tax = A x W – B

Reference: menu

This menu item provides an easy way to get tax scales from one database into another. This means that time and energy can be saved by entering tax scales into one database and then importing them into any other databases that may be in use.

Last edit 25/06/22